Credit Card Defaults Soaring, Highlighting Consumer Financial Strain in 2025

Account Recovery

JANUARY 2, 2025

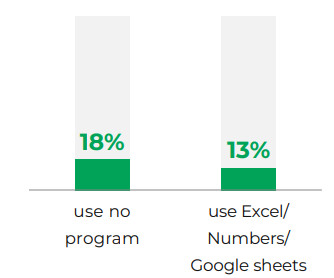

Defaults on credit card debt have surged to their highest levels since the 2008 financial crisis, signaling worsening financial conditions for lower-income consumers amid persistent inflation and elevated interest rates. By the numbers: The big picture: Consumers are feeling the pinch as higher balances and borrowing costs erode their financial stability: Between the lines: The pandemic-era surge in savings and consumer spending gave credit card issuers confidence to extend credit to riskier bor

Let's personalize your content