Explained: The Adrenaline-Driven Rise to GameStop Stock

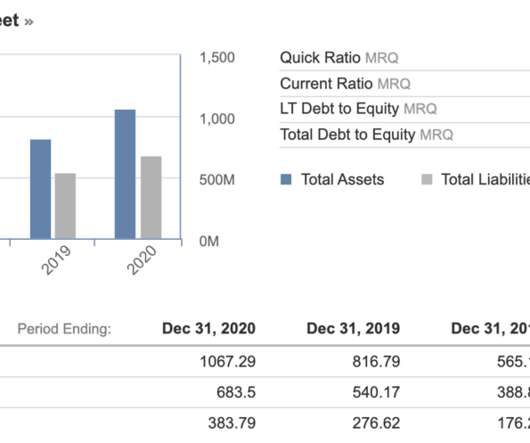

Credit Corp

JANUARY 28, 2021

A few weeks ago, the company ( stock trading as ticker: GME) traded around lows of ~$19. They embarked on new initiatives, including the acquisition of Spring Mobile in 2013. Well, A Trading Euphoria Caused By …. But in this trading saga, Reddit users had driven up the price by buying so much.

Let's personalize your content