A New Era for Debt Collection?

Burt and Associates

OCTOBER 31, 2024

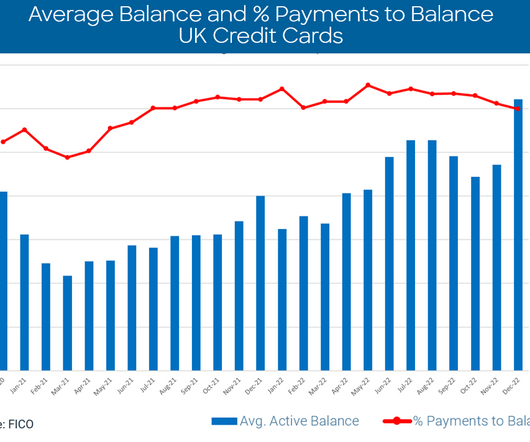

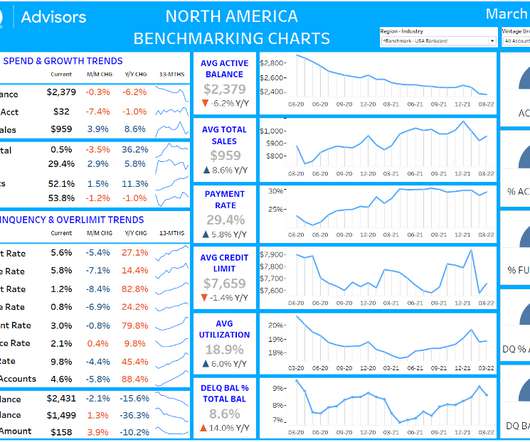

About Transcript About CFPB 2024 Annual Report on Activities to Administer the Fair Debt Collection Practices Act I. Introduction: This section highlights the CFPB’s work on medical debt issues, including a proposed rule to restrict medical debt reporting on credit reports. Consumer Debt and Collections 2.1

Let's personalize your content