Is It Better To Declare Bankruptcy or Debt Consolidation?

Sawin & Shea

JANUARY 24, 2024

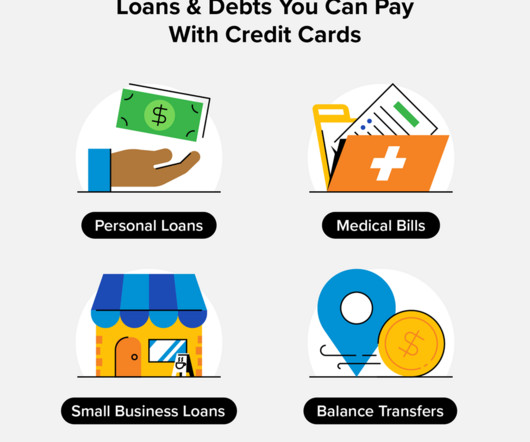

Any debts not discharged, like student loans, remain. How Debt Consolidation Works Debt consolidation combines multiple debts into one new loan or credit line. Common approaches include balance transfer credit cards, debt consolidation loans, home equity loans, and lines of credit.

Let's personalize your content