Here’s your accounts receivable checklist for the coming year

American Profit Recovery

JANUARY 9, 2024

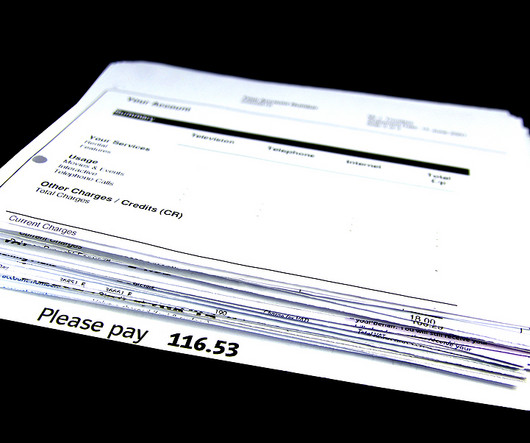

If your business is at a point where you know you can improve cash flow, there are many things that you can address internally that can advance your chances of better cash flow. If you’re running a small business, you may be cleaning up your books anyway to hand them off to your CPA for tax season. So why not in the process, take a hard look at your accounts receivable process and make any necessary changes.

Let's personalize your content