The Importance of Compliance in the Collections Industry

Optio Solutions

SEPTEMBER 19, 2023

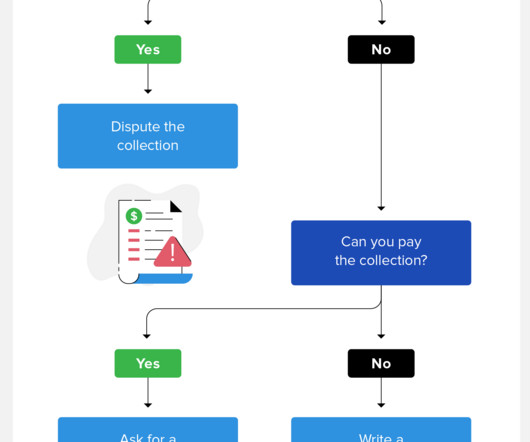

Optio Solutions, a prominent player in the industry, has positioned itself at the forefront of compliance efforts, setting a gold standard for collections agencies. Compliance is not just a legal requirement but also a crucial element for long-term success in the collections industry, and for our clients, brand protection. Compliance: A Legal and Ethical Imperative… The post The Importance of Compliance in the Collections Industry appeared first on Optio.

Let's personalize your content