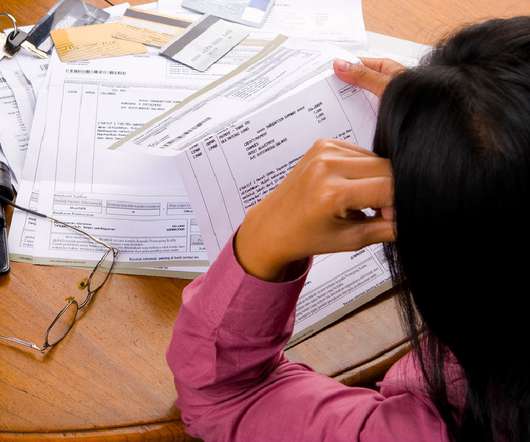

How Late Can You Be on a Car Payment, Mortgage or Other Bill?

Credit Corp

JUNE 14, 2023

How Late Can You Be on a Mortgage Loan Payment? How Late Can You Be on Student Loans? Car Repossession It’s important to realize that an auto loan is a type of secured loan. The vehicle you purchase serves as collateral for the loan. This process is referred to as repossession.

Let's personalize your content