CFPB Orders Remittance App Provider to Pay $3M for ‘Cheating’ Consumers

Account Recovery

OCTOBER 18, 2023

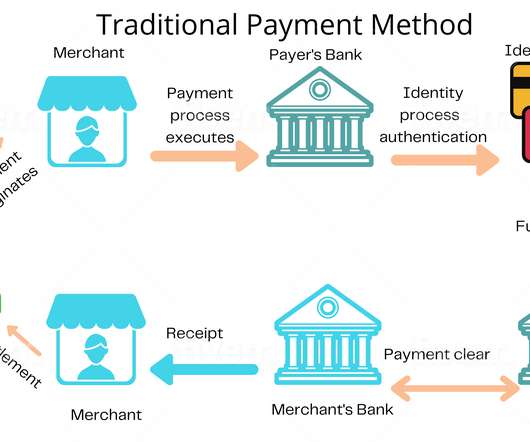

The Consumer Financial Protection Bureau yesterday entered into a consent order with a fintech company that operates a remittance transfer app that will see the company pay $3 million in fines and refunds to customers after it was accused of forcing customers to waive their legal rights, failing to provide required disclosures, and failing to […] (..)

Let's personalize your content