How to Stop Capio Partners

Debt Collection Answers

MAY 18, 2023

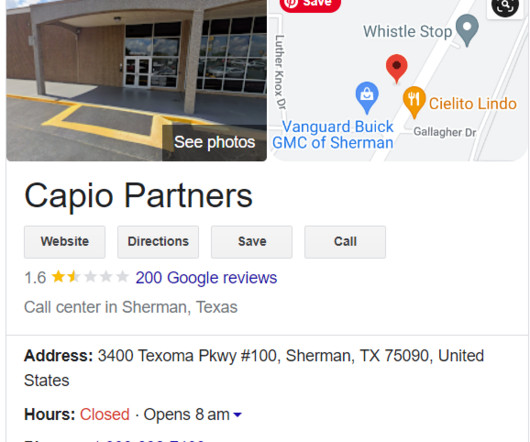

Even the most carefully crafted financial plan can be thrown off by unforeseen healthcare costs. Adding to the burden, specialized debt collectors in the medical industry can compound the stress of an already challenging situation. Capio Partners is one such agency that focuses on debt collection in the medical field.

Let's personalize your content