Key Driver Transforming The Debt Collection Agencies Market 2025: Rising Consumer Debt Levels Fuel Growth In The Market

Collection Industry News

MARCH 30, 2025

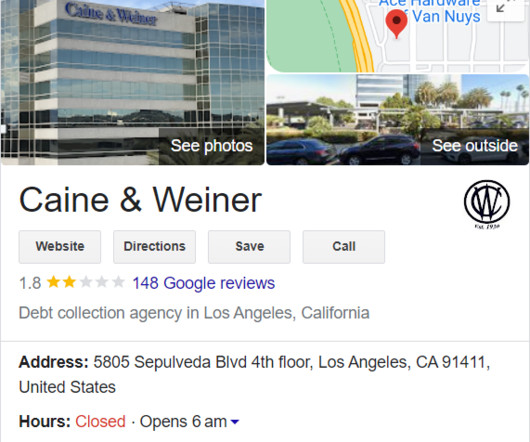

The Business Research Company’s Debt Collection Agencies Global Market Report 2025 Market Size, Trends, And Global Forecast 2025-2034 LONDON, GREATER LONDON, UNITED KINGDOM, March 31, 2025 /EINPresswire.com/ — Get 20% off on Global Market Reports until March 31st! KGaA, Experian plc, Atradius Collections B.V.,

Let's personalize your content