Collection Agencies in Puerto Rico

Nexa Collect

MARCH 12, 2021

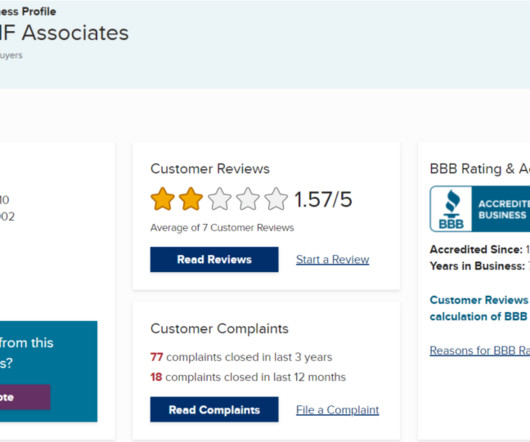

Debt collection agencies in PR include Kinum , TSI , CICA, ILCA and Professional recoveries. Spanish and English-speaking debt collectors are required for Puerto Rico debt collection. Need a Collection Agency in PR? Puerto Rico is one of the states that regulate the collection of fees and interest.

Let's personalize your content