Debt Settlement Firm to Repay Consumers $5.4M Under Agreement With CFPB

Account Recovery

MAY 18, 2021

Under Agreement With CFPB appeared first on AccountsRecovery.net.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Account Recovery

MAY 18, 2021

Under Agreement With CFPB appeared first on AccountsRecovery.net.

Account Recovery

DECEMBER 2, 2020

The Consumer Financial Protection Bureau yesterday filed a lawsuit against a debt settlement company, alleging it engaged in abusive and deceptive acts and practices by charging fees before it performed any services and collecting higher fees than it was supposed to.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Break Digital Transformation Barriers And Accelerate AI Adoption

The Human Side of Finance: The Intersectionality of People, Culture, Adaptability, and Resilience

Account Recovery

SEPTEMBER 1, 2021

AG Fines Debt Settlement Co. $1M Appeals Court Reverses Ruling For Plaintiff; Mass. 1M appeared first on AccountsRecovery.net.

Account Recovery

JULY 20, 2021

FDCPA Class Action Filed Against Law Firm, Debt Buyer; Bill Introduced in Ohio to Legalize Debt Settlement appeared first on AccountsRecovery.net.

Account Recovery

JANUARY 15, 2021

The Attorney General of Minnesota has obtained a settlement with a student loan debt relief company that illegally collected fees from individuals and misrepresented its services that will see the company pay the state more than $11,000 and cease operations in the state.

Account Recovery

MAY 18, 2021

SDNY Judge Dismisses FDCPA Case; Debt Settlement Firm to Repay Consumers $5.4M appeared first on AccountsRecovery.net.

Titan Consulting

SEPTEMBER 22, 2020

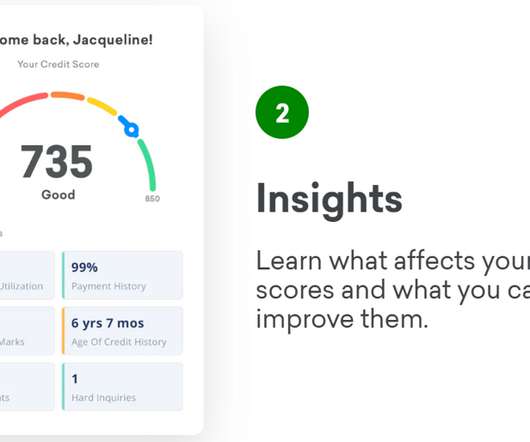

Multiple state and federal agencies strictly regulate the debt settlement industry. All types of debt relief programs come with negative consequences, including non-profit credit counseling and bankruptcy, and will directly or indirectly negatively impact your credit score. State and Federal Regulations for Debt Settlement.

Account Recovery

OCTOBER 22, 2024

SoloSuit, a legal tech startup helping consumers resolve debt collection lawsuits, has named Attorney Yale R. Levy, founder of Levy & Associates, LLC, a multi-state collection law firm, and former President of the National Creditors Bar Association (NCBA), brings decades of debt collection expertise to the company.

Account Recovery

DECEMBER 2, 2020

Judge Denies MTD in FDCPA Case Over Reference to Creditor; CFPB Sues Debt Settlement Company appeared first on AccountsRecovery.net.

PDC Flow

JANUARY 29, 2024

Debt settlement campaigns are initiatives where debt collection agencies offer a discount to consumers to boost collection on old or unresponsive accounts. Tax season is the best time to consider a debt settlement campaign within your debt collection agency.

Debt Recoveries

SEPTEMBER 30, 2020

I know debt collection can be an uncomfortable process, even for large businesses. These tips are designed to help you understand the options you have for debt collection, before you go down the legal path. Don’t wait to take action on a debt. The longer a debt remains unpaid the less likely you are to collect.

Credit Corp

JULY 9, 2021

There are situations in which settlement will affect your score less than the available alternatives. How does debt settlement affect your credit? For what amount of time will the history of a settlement decision follow you? How Debt Settlement Works. Debt Settlement: Pros and Cons.

Account Recovery

APRIL 19, 2021

The Attorney General of Minnesota has reached a settlement with a student loan debt relief company that was accused of falsely promising student loan forgiveness which will see the company repay all the money it collected from customers in the state and cease operations in Minnesota until it registers as a debt settlement service provider.

Credit Corp

FEBRUARY 13, 2025

Debt settlement, also known as debt negotiation or debt resolution, means your creditors have agreed to accept less than the full amount you owe them. If youre considering working with a debt settlement company to negotiate or settle your debts , you should ask them some essential questions before signing up.

Account Recovery

FEBRUARY 8, 2023

Having spent 14 years in the debt settlement industry, Jackson knows her way around collections. Her plan now is to become an expert in collections, just as she … The post Getting to Know Janneen Jackson of Phillips & Cohen Associates first appeared on AccountsRecovery.net.

Direct Recovery

JANUARY 8, 2021

With that in mind, let’s take a quick look at the three common costs associated with any type of debt settlement agreement. The most obvious cost associated with any debt settlement agreement is the amount the creditor is willing to accept in order to clear the debt off of their books. The Upfront Cost of the Deal.

Credit Corp

JANUARY 21, 2021

A collections notice shows up, a debt collector starts calling or you find a negative report on your credit history, but you know you paid the account in question. Can you sue a company for sending you to collections for money you didn’t owe? How Does the Law Protect Your Rights Regarding Credit Collections and Reporting?

PDC Flow

FEBRUARY 29, 2024

That’s why tax refund season is one of the busiest times of the year for debt collection agencies. Lots of companies might want to establish a tax time collection campaign but don’t know how to prepare. Here are three ways to enhance your upcoming tax season debt collection efforts.

Titan Consulting

SEPTEMBER 15, 2020

Therefore, creditors of unsecured debt are often willing to accept less than the full balance owed if you are unable to pay off the balance in full. Professional debt settlement companies can help you negotiate debt for less than the full balance owed if you find the process intimidating or overwhelming.

Collection Industry News

JUNE 5, 2022

On May 26, 2022, the North Carolina Attorney General (NC AG) announced that it obtained a default judgment against a California-based debt settlement business, and its proprietor. Specifically, the NC AG alleged that the defendants unlawfully collected up advance ?fees Source: site. View source.]. View source.].

Account Recovery

FEBRUARY 9, 2023

Having spent 14 years in the debt settlement industry, Jackson knows her way around collections. GETTING TO KNOW JANNEEN JACKSON OF PHILLIPS & COHEN ASSOCIATES Janneen Jackson may be new to the accounts receivable management industry, but she is one of the most experienced rookies the industry has seen in a while.

Collection Industry News

JUNE 7, 2021

Cristian Cortez incurred credit card debt which was placed with Forster & Garbus LLP for collection. The company mailed him a number of collection notices. The company’s settlement offer wasn’t required under the Fair Debt Collection Practices ….

Collection Industry News

APRIL 27, 2021

On April 13, the CFPB entered into a preliminary settlement with an online debt-settlement company for allegedly violating the CFPA’s prohibition on abusive acts or practices and failing to clearly and conspicuously disclose total cost under the Telemarketing Sales Rule. Source: site.

Collection Industry News

MAY 16, 2022

According to the complaint, the defendants, a student loan debt relief business and a general debt-settlement company, along with their owner and CEO charged illegal upfront fees and deceived customers into paying for debt relief services in violation of the Consumer Financial Protection Act (CFPA) and Telemarking Sales Rule (TSR).

Better Credit Blog

FEBRUARY 11, 2022

Rated the best debt relief company on Trustpilot. A Guide to Debt Settlement Services. If you’re on the brink of bankruptcy, a final option before filing is to try the services of a debt settlement firm. As Experian notes , “Debt settlement is a risky process with no guarantee of success.”.

Collection Industry News

APRIL 22, 2023

That plan, which would cost more than $400 billion and affect upward of 40 million borrowers, is significantly broader than the class-action settlement. The post Supreme Court allows $6 billion student loan debt settlement appeared first on Collection Industry News.

Credit Corp

MARCH 16, 2021

The concept of the debt snowflake method is simple. You make tiny extra payments on the debts with your savings like snowflakes and work towards zero debt. Debt snowflake is a debt elimination method where small savings collected over time and extra income can make a big impact on your debt repayments.

Better Credit Blog

APRIL 1, 2022

To remove Capital One Collections from your credit report, you first need to know who currently owns the debt. In other words, has Capital One sold your unpaid credit card debt to another collection agency, or is the debt still with Capital One? Steps To Remove Capital One Collections From Your Credit Report.

Credit Corp

AUGUST 24, 2021

This is to help ensure that all outstanding items are being looked at and help the counselor understand if you’re dealing with collections. This might include options such as budgeting, debt settlement, consolidation loans, or debt management programs. Debt settlement.

Better Credit Blog

APRIL 11, 2022

You may be sent to collections. If you’re past due on your card and loan payments and your grace period has ended, it may go to collections. Debt Settlement. The debt settlement method is closely related to DMPs, but there are differences. A debt settlement company is for-profit. Bankruptcy.

Taurus Collect

DECEMBER 30, 2022

Ultimately, they can also hire a debt collection agency to pursue the money you owe to them. Read on to understand how to respond when your debt is sent to collections. You may panic upon learning that there is a debt collection agency after you to retrieve the amount you owe to your creditors.

Taurus Collect

JUNE 12, 2023

Thus, debt collection agencies are commonly utilised to ensure that funds due back to businesses don’t go unpaid. But how often do debt collection agencies take their clients’ customers to court? But did you know that these agencies often try to resolve your debt before resorting to legal action?

FFGN COLLECT NY

DECEMBER 11, 2023

An experienced legal professional knows that any misstep during debt collection can lead to serious legal repercussions. To collect debt for a client, New York attorneys must understand and implement ethical practices during debt collection. Be clear and respectful.

Better Credit Blog

APRIL 4, 2022

Regardless of what a debt collector might tell you, you have a lot of rights when it comes to how debt can be collected. In fact, merely mentioning that you understand your rights will, many times, stop debt collectors in their tracks. Your rights come from the Fair Debt Collection Practices Act (FDCPA).

Better Credit Blog

FEBRUARY 17, 2021

Fidelity National Collections is a medical debt collection company that works on behalf of healthcare providers to recover unpaid balances. Apart from their calls and letters, Fidelity Collections can have a detrimental effect on your credit score. About Fidelity National Collections. Ask Lex Law for Help.

Sawin & Shea

AUGUST 24, 2020

Bankruptcy will wipe out credit card debt, medical bills, and personal loans, but will not eliminate primary obligation debt; things like student loans, child and spousal support, and newer tax debt. Bankruptcy can also stop or delay a home or mortgage foreclosure, stop collection actions, stop garnishments and lawsuits.

Debt RR

APRIL 5, 2022

Commercial debt can accrue to a considerable sum, and if you are in such a situation, you are liable to pay off all the debts. Failure to pay them off promptly, or even paying the amount due when the time comes, could result in a civil lawsuit for commercial debt collection.

The Kaplan Group

OCTOBER 19, 2020

FDCPA ( Fair Debt Collection Practices Act). The Fair Debt Collection Practices Act (FDCPA) is a federal law that restricts the behavior of collection agencies when they are attempting to collect money from individuals. The law does not apply to collecting from businesses. Debt Settlement Services.

Debt Guru

AUGUST 30, 2021

When your voicemail is filled with messages from collection agencies and stacks of bills arrive in your mailbox that you have no chance of paying, it’s time for some serious debt relief help. You must speak to a bankruptcy attorney to find out whether or not you qualify for this type of debt relief. Debt Settlement.

Debt Free Colorado

NOVEMBER 13, 2017

Offers for debt settlement and debt repayment plans often sound too-good-to-be-true. government agency that makes sure banks, lenders, and other financial companies treat you fairly”, Freedom Debt Relief’s offers actually were too-good-to-be-true. settlement providers, by contacting your creditors directly.

Sawin & Shea

FEBRUARY 2, 2022

Debt Settlement. Debt settlement is an option, but it should be the thing you consider last because it generally requires you to default with your creditors first. However, this requires that you have a large lump sum available to pay the settlement, as they do not offer a payment plan.

Nexa Collect

JULY 1, 2020

If your name changes or has variations, make sure that you’re consistently using your official name and that you notify the three credit bureaus of any changes as soon as possible. You may have paid your debt to a collection agency, but they still reported it by mistake. Same debt listed twice or incorrect balances.

Consumer Financial Services Law

JANUARY 11, 2017

A New York District Court recently addressed the issue of whether the FDCPA requires passive debt buyers to personally register disputes or whether they can delegate that obligation to their third party debt collector/servicer. Passive debt buyers purchase debt but retain third parties to service and collect the debt.

Credit Corp

DECEMBER 3, 2024

Consider debt settlement Step 6. Negotiations may help you reach a debt settlement or new payment plan that could encourage the lender to resolve the repossession on your credit report. Every lender wants to collect the money it owes, and many will be open to negotiating a payment plan. Dispute Inaccuracies Step 4.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content