Student Loan Collections Resume Today

Account Recovery

MAY 5, 2025

After a five-year hiatus, the Department of Education will resume involuntary collections on federal student loans today, impacting millions of borrowers already in default.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Account Recovery

MAY 5, 2025

After a five-year hiatus, the Department of Education will resume involuntary collections on federal student loans today, impacting millions of borrowers already in default.

Account Recovery

SEPTEMBER 14, 2020

A District Court judge in Connecticut has granted a motion to dismiss filed by a collection agency, a student loan servicer, and the plaintiff’s employer for allegedly violating the Fair Debt Collection Practices Act by attempting to garnish the plaintiff’s wages, because the statute of limitations on filing a claim had passed when the (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Agent Tooling: Connecting AI to Your Tools, Systems & Data

The Hidden Science Behind Why Finance Teams Resist Change—And How to Fix It

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: The New Way To Lead

Account Recovery

SEPTEMBER 14, 2020

Judge Grants MTD in Student Loan Collection Case; Unlicensed Debt Collector Arrested in N.C. appeared first on AccountsRecovery.net.

Sawin & Shea

NOVEMBER 30, 2022

Student loan default can impact millions of Americans. Unfortunately, defaulting on a student loan can hurt your finances, credit, and other aspects of your life. If you fall behind on student loan payments, your loan won’t default immediately. What Are My Options After Defaulting on Student Loans?

Account Recovery

APRIL 15, 2024

in Student Loans Oregon Gov. Signs Garnishment, Collection Bill into Law Compliance Digest – April 15 WORTH NOTING: Meet a guy who likes to scam the scammers … Why a shortened workweek is gaining steam here in America with CEOs … […]

Credit Corp

MAY 17, 2021

But those who are struggling with debt might wonder: Can my stimulus check be garnished for credit card debt or other money owed. In some cases, the money you get from the third stimulus could be garnished. Federal Student Loan Debt: No. This is not necessarily true for private student loans, though.

Nexa Collect

JUNE 27, 2023

Recovering unpaid student loans is a systematic process. Just like mortgage recoveries, the steps can vary depending on the jurisdiction and the terms of the loan. Employ a Collection Agency : If the borrower is unresponsive or unwilling to pay, employ the services of a collection agency.

Titan Consulting

JUNE 7, 2020

Congress recently passed legislation in the CARES act that provides direct and indirect benefits to Federal Student Loan borrowers. Benefits include a suspension of payments, no negative credit reporting, no collection activity, and no accrual if interest until September 30, 2020. Help Available for Borrowers with Student Loans.

Credit Corp

JULY 9, 2024

Ignoring student loans can damage your credit score, lead to wage garnishment, and accrue interest and fees. It may also result in legal action, tax refund offsets, and impact co-signers, making it crucial to address repayment issues promptly with your loan servicer. What Happens If I Don’t Pay My Student Loans?

Credit Corp

DECEMBER 14, 2020

Whether you have medical debt, credit card debt or unpaid student loans , getting calls or letters from debt collection companies can be frustrating. Can a debt collector collect after 10 years? Here’s an overview of the timelines for debt collection and what to do if you’re contacted about an old debt.

Credit Corp

JUNE 3, 2020

The company, creditor or collection agency has legal ways to pursue payment. The judgment creditor can then use that court judgment to try to collect money from you. Common methods include wage garnishment , property attachments and property liens. This is known as wage garnishment. Nonwage garnishment.

Debt RR

AUGUST 3, 2020

This unpaid debt can lead to a serious problem for businesses: garnishment. Bank account garnishment can create serious cash flow blocks for companies of all sizes, and those cash flow problems can compound into other issues, like payroll concerns and late payments on other accounts. Can Debt Collectors Garnish Bank Accounts in Texas?

Credit Corp

MAY 19, 2021

If you owe money and don’t pay it, a creditor typically has to get a judgment to be able to force the collection. They could just decide that it’s too expensive to try to collect the debt while you live outside of the country. You could face severe consequences if you choose not to continue making payments on your loans.

Debt Free Colorado

APRIL 9, 2020

While credit cards and other unsecured loans are almost always the most aggressive when it comes to collecting debts, they should generally be your lowest priority. Student Loans. You should call your student loan servicers about forbearance, which will temporarily stop or reduce your payments. Credit Cards.

FFGN COLLECT NY

JANUARY 10, 2024

On Tuesday, January 9, New York Governor Kathy Hochul delivered the 2024 State of the State address, discussing certain changes that will affect debt collection within the state. Hochul specifically mentioned student loan servicers who encourage the quickest repayment plans or plans not suitable for the party repaying.

Troutman Sanders

SEPTEMBER 19, 2022

The standard courts should use to determine whether an alleged Fair Debt Collection Practices Act (FDCPA) violation is material remains unsettled. Pioneer) to help collect the debt. The packet’s first two pages contained information about the alleged debt and ordered the employer to garnish the plaintiff’s wages. In Tavernaro v.

Sawin & Shea

AUGUST 24, 2020

Bankruptcy will wipe out credit card debt, medical bills, and personal loans, but will not eliminate primary obligation debt; things like student loans, child and spousal support, and newer tax debt. Bankruptcy can also stop or delay a home or mortgage foreclosure, stop collection actions, stop garnishments and lawsuits.

Credit Corp

JUNE 14, 2023

How Late Can You Be on a Mortgage Loan Payment? How Late Can You Be on Student Loans? But most of the time, you must miss a number of payments in a row before the account is sent to collections. How Late Can You Be on Student Loans? Many federal student loans provide a 15-day grace period.

Better Credit Blog

APRIL 1, 2022

A good credit score allows you to get better rates on car or mortgage loans just to name a few. If you fall into hard times, the inability to pay off your credit card bills or student loans can result in your debts being transferred to a debt collection agency. Have a Professional Remove the Collection.

Sawin & Shea

MARCH 30, 2021

Collect copies of all invoices you sent out. You will be able to download a record of your bank deposits. This will be true whether you deposited cash or checks (and the bank provides pictures of checks you have deposited). Don’t include invoices that you have sent out that have not yet been paid by your clients.

Better Credit Blog

APRIL 3, 2022

Portfolio Recovery Associates, LLC, is a collection agency that buys old debts from lenders and companies that have been unable to collect the debt themselves. In other words, when the original creditor has been unsuccessful in collecting on a debt, it will write off the debt as a loss. How Portfolio Recovery Associates Works.

Collection Industry News

MARCH 17, 2024

On Tuesday, January 9, New York Governor Kathy Hochul delivered the 2024 State of the State address, discussing certain changes that will affect debt collection within the state. Hochul specifically mentioned student loan servicers who encourage the quickest repayment plans or plans not suitable for the party repaying.

Credit Corp

MAY 30, 2023

This is known as wage garnishment. The Consumer Credit Protection Act caps these types of garnishments. Nonwage garnishment. If you’re retired, unemployed, or self-employed, your bank account may be garnished instead. Veterans payments, social security, and disability benefits are not eligible for nonwage garnishment.

Collection Industry News

NOVEMBER 8, 2021

More than eight million Americans were in default on their student loans as of June. They represent roughly one-fifth of the 43 million Americans who held federal student debt. The department is currently conducting such a rulemaking to reform major pieces of the student loan repayment system.

Better Credit Blog

AUGUST 31, 2020

Having debt in collections can be downright overwhelming, especially when debt collectors bombard you with dozens of phone calls. What you may not know is that you are protected by the Fair Debt Collection Practices Act (FDCPA), a law designed to keep third-party debt collectors in check when they contact you. Table of Contents.

National Service Bureau

APRIL 6, 2015

Debt collection companies walk a fine line between business efficiency in their primary function (accounts receivable management), while at the same time needing to respect the fact that the debtor is a valuable client to the business for whom they are running collections. 5: Improper contact or sharing of information. Government.

Taurus Collect

JANUARY 24, 2023

But while it can be exciting to think about that refund cheque hitting your bank account soon, there’s another equally pressing reason why you should pay attention this tax season – debt collection! One of the most common strategies employed by debt collection companies is sending frequent letters or calls reminding you of unpaid debts.

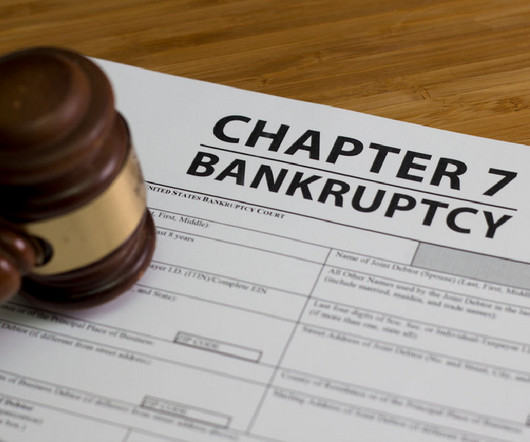

Sawin & Shea

JANUARY 18, 2023

Filing Chapter 7 bankruptcy provides you with an automatic stay that prohibits creditors from being able to take any action to collect a debt against you, such as repossessions, wage garnishment, and legal action. What Happens After You File Chapter 7 Bankruptcy? Additionally, your creditors will not be allowed to contact you.

Collection Industry News

JULY 20, 2020

DEBT COLLECTORS, facing growing demands to freeze the collection of debt across the country amid the economic hardship caused by the coronavirus pandemic, are mobilizing their lobbyists to push back. In New York, residents are receiving a 30-day reprieve from the collection of state-owned medical and student debt.

Katabat

DECEMBER 7, 2021

Collections Industry Increases Hiring and Technology Investments While Preparing for the ‘Next Normal.’”. The report also notes that auto debt increased by $28 billion in the third quarter and student loan balances grew by $14 billion. Student Loan Borrowers Beware: Government Collection Activities Resume Next Year.”.

Katabat

DECEMBER 7, 2021

Collections Industry Increases Hiring and Technology Investments While Preparing for the ‘Next Normal.’”. The report also notes that auto debt increased by $28 billion in the third quarter and student loan balances grew by $14 billion. Student Loan Borrowers Beware: Government Collection Activities Resume Next Year.”.

Sawin & Shea

JANUARY 25, 2022

However, if you file for bankruptcy, it can put a pause on debt collection, including actions by secured creditors. Instead, when a debtor fails to pay, the lender must first file a lawsuit in order to collect what is owed. What collection remedies are allowed will vary by state. Examples of Unsecured Debts.

Collection Industry News

JUNE 1, 2023

Introduction: The debt collection industry plays a vital role in the global economy, helping businesses recover outstanding debts and maintain financial stability. The growing complexity of financial products, such as credit cards, mortgages, and student loans, has led to a surge in outstanding debts.

Troutman Sanders

MARCH 22, 2021

Department of Education announced that about 72,000 student loan borrowers, who were defrauded by their schools, will receive student loan forgiveness that could total $1 billion. The bill also would require such payments to be encoded, and would extend other restrictions on collection of such funds.

Sawin & Shea

JANUARY 24, 2024

The Pros Bankruptcy can stop foreclosures , repossessions, lawsuits, wage garnishment, utility shut-offs, and debt collection activities through its automatic stay provision. Any debts not discharged, like student loans, remain. At the end of the plan, any unpaid balances on the qualifying debts are discharged.

Collection Industry News

FEBRUARY 15, 2021

In the area of debt collection, the CFPB observed, among other things, that some entities reported increases in consumer contacts and payments, which may have been attributable to more consumers being at home, reduced spending, and pandemic-related assistance. insufficient loss mitigation processes.

Sawin & Shea

MAY 2, 2024

Whether you’re facing foreclosure , repossession, wage garnishments, or relentless creditor harassment, our expertise in bankruptcy law can offer the protection and relief you’ve been seeking. Student loans are also difficult but not impossible to discharge in bankruptcy.

Better Credit Blog

AUGUST 25, 2020

When a collections account makes its way onto your report, it can do a surprising amount of damage to your credit score. The agency has been in the business of debt collection since 1980. Though they collect from debtors across the nation, their headquarters are in Cleveland, Ohio. Outsourcing debt collections.

Better Credit Blog

SEPTEMBER 8, 2020

Since your payment history constitutes 35% of your credit profile, and the longer a debt goes unpaid the more damage it does, a collections account can be devastating to your score. While they aren’t a household name, they collect for some well-known service providers. Student loans. Bloomington, MN 55438. Credit cards.

Sawin & Shea

MARCH 7, 2023

When you file for Chapter 7 bankruptcy, the Court will place an automatic stay upon filing, which stops creditors from collecting payments, garnishing wages, or repossessing property. Chapter 7 bankruptcy, also known as liquidation or straight bankruptcy, can help those having financial difficulties clear away various types of debts.

Sawin & Shea

SEPTEMBER 27, 2023

If you are a victim of debt collector harassment, it’s important to know the debt collection laws, and consider your options for debt relief. Debt Collection Laws: What Can Debt Collectors Do? Debt collectors have a legal right to pursue the collection of personal debt within the bounds of the law. What Are My Next Steps?

Debt Free Colorado

DECEMBER 23, 2024

Quick Summary: Filing for bankruptcy stops all debt collection right away through the automatic stay. Student loans, child support, recent taxes, and court fines must be paid in full. This process can stop creditors from collecting money from you. If you fail to pay, creditors cannot take your belongings.

Troutman Sanders

DECEMBER 20, 2022

On December 15, the Office of the Comptroller of the Currency, along with the Federal Financial Institutions Examination Council, released revised procedures for how its examiners will investigate financial institutions for Fair Debt Collection Practices Act compliance, incorporating Regulation F changes into their review.

Debt Free Colorado

DECEMBER 7, 2016

Lawsuits, garnishments, foreclosures, and other collections stop at this time. Certain taxes, student loans, child or spousal support, fees owed the government, and other debts aren’t affected. The Trustee collects these assets. All the debts listed in your case that can be discharged are wiped out.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content