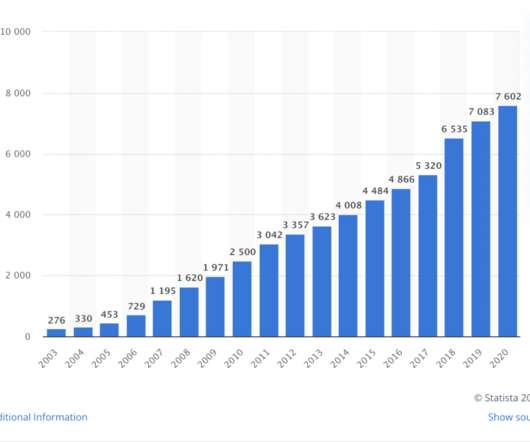

New Survey: 93% of Companies See Revenue Loss from Late Payments—Some Lose Over 10%

The Kaplan Group

APRIL 28, 2025

An exclusive new 2025 survey from The Kaplan Group reveals the significant revenue and cash flow risks businesses face from delayed paymentsparticularly for mid-sized firms and industries like SaaS, healthcare, and professional services. Healthcare firms : 33.3% Manufacturing companies : 91.3% Technology/SaaS firms : 44.4%

Let's personalize your content