The Lenders Giving Borrowers Second Chance Loans

Credit Corp

DECEMBER 14, 2020

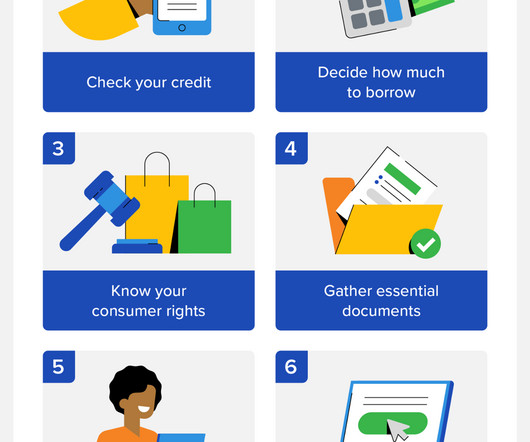

Community Development Financial Institutions, which include banks, credit unions, loan and venture funds, are making second-chance loans where others may fear to tread. “We We might pull their credit report and show them how they can improve their credit score,” Pinsky explains. Flexible loan amounts.

Let's personalize your content