The Pros and Cons of Voluntary Repossession

Credit Corp

MARCH 12, 2025

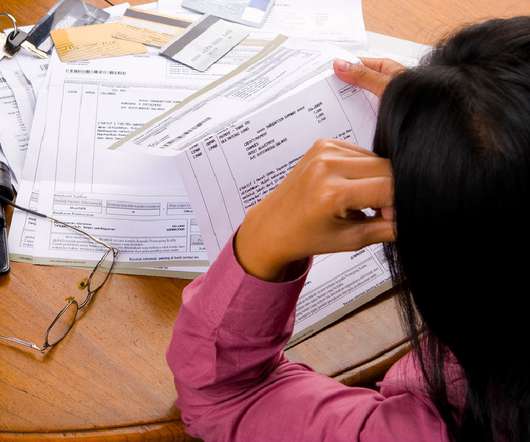

If you are having a hard time keeping up with a car loan, voluntary repossession may be a good option to get the burden of late payments off your hands. Voluntary repossession damages your credit score, and you may still owe money if the vehicle sale doesnt cover the loan balance. What Is Voluntary Repossession?

Let's personalize your content