AFSA Submits Comment Letter on Proposed Amendments to NYC Debt Collection Regs

Account Recovery

DECEMBER 16, 2024

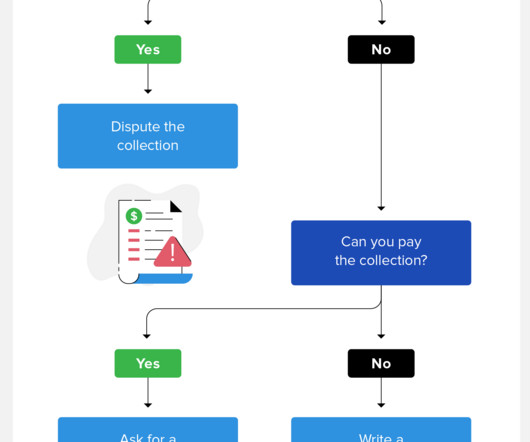

Proposed amendments to New York Citys rules governing debt collection have drawn significant scrutiny from trade groups outside the collection industry, most notably the American Financial Services Association (AFSA), which submitted a comment letter last week regarding the proposed amendments. What theyre saying: Learn more.

Let's personalize your content