California Governor Signs Trio of Collection-Related Bills into Law

Account Recovery

SEPTEMBER 25, 2024

The states are following the lead of the Consumer Financial Protection Bureau, which is proceeding with a similar proposal.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Account Recovery

SEPTEMBER 25, 2024

The states are following the lead of the Consumer Financial Protection Bureau, which is proceeding with a similar proposal.

Credit Corp

DECEMBER 14, 2020

And unlike traditional loans, consumers with poor or slim credit histories may find that their creditworthiness gets judged in part by how they have handled utility bills or rent – transactions that usually don’t appear on credit reports. Sometimes it’s a foreclosure, increasingly often it’s due to large medical bills,” Pinsky notes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Future-Proof Your Firm: Smarter Tech for Stronger Returns & Simpler Workflows

Operational Strength Starts with People: The New Rules of Finance Leadership

Going Beyond Chatbots: Connecting AI to Your Tools, Systems, & Data

Protect What Matters: Rethinking Finance Ops In A Digital World

Jimerson Firm

NOVEMBER 2, 2020

Lenders are responsible for servicing and liquidating all of the 7(a) loans in their portfolio. Lenders and CDC’s must be cognizant about their responsibilities and authority in servicing and liquidating SBA loans because failure to do so properly may lead to formal enforcement actions by the SBA Office of Credit Risk Management.

Credit Corp

JUNE 4, 2024

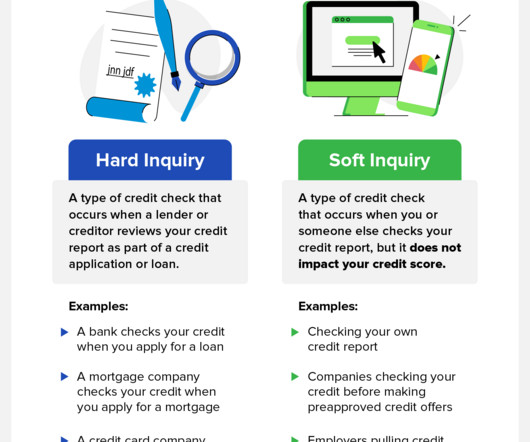

If you’re using a significant portion of your available credit, it can indicate to lenders that you may be overextended and unable to manage additional debt responsibly. If you’ve recently applied for multiple new credit accounts within a short period, it can signal to lenders that you may be a risky borrower.

Micro Bilt

SEPTEMBER 13, 2023

There are many ways to determine someone's creditworthiness. This contemporary scoring method gives lenders a modern way of measuring a consumer's creditworthiness using factors not traditionally considered.

Credit Corp

MAY 10, 2023

Your credit score is an important aspect of your financial health and is oftentimes used by lenders, landlords, and even employers to determine your creditworthiness. Hard inquiries , also known as hard pulls, are typically made by lenders and other financial institutions and can harm your credit score. What’s a Hard Inquiry?

Credit Corp

MARCH 7, 2021

Online lenders make it easy to compare rates and terms and find the right online personal loan for your situation. That is, the lender advances you money that you pay back with interest over a predetermined period of time. This often allows digital lenders to streamline the applications. Benefits of Online Personal Loans.

Nerd Wallet

JUNE 22, 2021

A signature loan is a fixed-rate, unsecured personal loan offered by an online lender, bank or credit union. Getting approved for a signature loan will likely depend on your creditworthiness. It’s called a signature loan because it’s secured by your signature instead of collateral, like a car or an investment account. The best way to.

Fico Collections

JUNE 30, 2023

Origination is just the initial phase of the long and complex mortgage lifecycle, which begins with a lender qualifying a borrower and then providing the funds used to purchase a new property or refinance an existing property. The lender then holds the mortgage on its balance sheet or sells the mortgage on the secondary market to investors.

Credit Corp

AUGUST 5, 2020

The Index, which is brought to you by the makers of the popular FICO Score for creditworthiness, ranges from 1 to 99. As of July 2020, the FICO Resilience Index is being provided in pilot testing to lenders. Lenders are still concerned with whether or not someone is a “good risk.”

Collection Industry News

AUGUST 30, 2022

And now we can add mortgage lender bankruptcies — and the rise (and fall) of “non-qualified mortgages” — to the factors aggravating an already uncertain market. They’ve previously been touted as an option for creditworthy borrowers who can’t otherwise qualify for traditional mortgage loan programs.

Titan Consulting

MAY 17, 2020

As lenders acknowledge the need for alternative credit data, companies are finding innovative ways to track non-traditional payments without requiring consumers to borrow money or use a credit card. What lenders use alternative credit data to grant credit? Can alternative credit data be used to improve my credit score?

Credit Corp

MARCH 6, 2023

Portrait of a professional businessman standing in an office with colleagues in the background Businesses, lenders, landlords and even some employers use your credit score to determine your creditworthiness. Nearly every lender in the country uses credit reports to determine whether they approve a loan application.

Debt Free Colorado

FEBRUARY 21, 2022

Lenders, creditors, finance businesses, and payday lenders are all required by the UCCC to inform consumers about the cost of credit so that they can shop around for the cheapest rates. Except for requirements that lenders disclose the cost of credit and provide customers with limited legal remedies if the UCCC is breached.

Credit Corp

AUGUST 18, 2021

Mortgage lenders use various different FICO score iterations to make lending decisions—specifically FICO 2, FICO 4 and FICO 5 scores. It’ll show you the credit score that auto, home, credit card lenders see—and more. . Monitoring your credit report and your credit score can help you understand your creditworthiness.

Debt Guru

MARCH 6, 2020

Use the same formula that lenders rely on when evaluating a loan application. The result is a percentage that determines your creditworthiness – in short, if lenders believe you’ll be able to repay the loan. Start by determining how your debt compares to your income. You could afford to shoulder more liability.

Collection Industry News

MAY 18, 2021

While consumer groups praised the bill for its recourse for consumers harassed by debt collectors, CUNA and NAFCU saw the bill as complicating the legal relationship between consumers, members and lenders. In the letter, Nussle stated, “Lenders rely on complete and accurate credit reports when underwriting loans.

Nexa Collect

AUGUST 13, 2020

Similar to a consumer’s credit score, a business’s credit score represents its creditworthiness. Each has its own way of gathering data and scoring your business, but they all look for information from investors, lenders, banks, and credit card issuers. The way this can backfire is that lenders, in general, frown upon this practice.

Credit Corp

JUNE 12, 2023

A personal loan is money borrowed from a lender that can be used for almost any purpose, from debt consolidation to home improvement projects. You have to receive a personal loan through an authorized lender, typically a bank or credit union. This can range anywhere from months to years, depending on the lender and your needs.

Credit Corp

MAY 23, 2021

Incorrect Personal Information Lender Inquiries You Don’t Recognize Accounts You Never Opened Credit Utilization Goes Up Credit Score Goes Up or Down Unexpectedly Public Records You Don’t Recognize. Warning Sign 2: Lender Inquiries You Don’t Recognize. Negative public records can substantially impact your creditworthiness.

Credit Corp

SEPTEMBER 27, 2023

Yet, whether or not you can do so depends on factors such as the lender’s policies or the type of loan you want to pay off. By now, you probably know that keeping track of your creditworthiness is essential for financial health, and regularly monitoring your credit report can help ensure your credit score is accurate.

Roths Child Law

APRIL 30, 2024

Following bankruptcy, managing credit card usage requires a strategic approach to rebuilding financial stability and creditworthiness. Understanding credit scores Understanding the intricacies of credit scores is crucial post-bankruptcy, as it highlights the significance of rebuilding creditworthiness.

Sawin & Shea

MARCH 23, 2022

While your score will not drop simply from switching careers or employers, lenders will look at this when determining if you are eligible for opening a new line of credit—and new lines of credit will help you rebuild your score. Maintain a “reliable” income. Moving from one job to the next can indirectly affect your credit score.

Sawin & Shea

FEBRUARY 8, 2023

Bankruptcies can impact your credit, but you can take steps today to rebuild your creditworthiness. Unlike secured credit cards, which require a security deposit that serves as collateral, unsecured credit cards are approved based on your creditworthiness, income, and other factors. Avoid opening too many credit card accounts.

Credit Corp

JUNE 7, 2020

Without an established credit history, it may be difficult to get lenders to extend you credit. Ongoing Apr: 12.99%, 17.99% or 22.99%, based on your creditworthiness. If you’re a new cardholder, try holding off for one year before applying for another credit card. on TD Bank's secure website. Card Details. Annual Fee: $0.

Credit Corp

AUGUST 3, 2020

It’s not in the interest of lenders to allow card holders to drive up balances with no end in sight. Cardholders on these accounts are given a limit that’s unique to them, and it’s based on factors such as creditworthiness, income, and how long you have had an account. What a No Limit Credit Card Really Means.

Better Credit Blog

JUNE 1, 2022

Here are the top 6 lenders for the best personal loans with bad credit: PersonalLoans.com. First things first: Do not visit a payday or title lender. PersonalLoans.com is not a lender. It’s a marketplace where you can compare lenders. Access to multiple lenders with one application. BadCreditLoans.com. CashUSA.com.

Credit Corp

SEPTEMBER 7, 2021

Most lenders review your FICO Score when making a financing decision. Regardless of the type of score, a proven record of responsible borrowing shows lenders that you’re more likely to pay back your debt, and then they can offer you lower interest rates and charge fewer fees. . It can keep you from getting the apartment you want.

Credit Corp

JANUARY 24, 2024

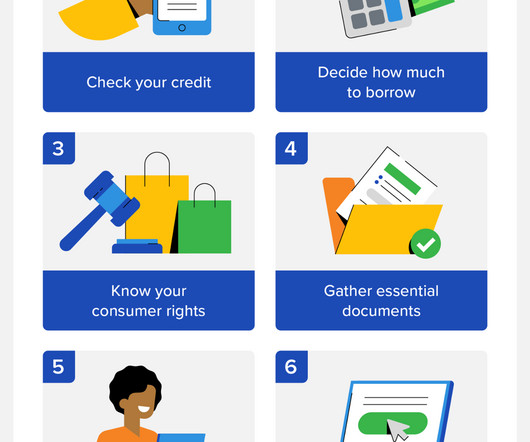

Lenders consider multiple factors when you apply for loans and credit cards , including your credit score and current finances. While the algorithms that determine your creditworthiness may be complex, the credit approval process itself is fairly straightforward. What Are the 5 C’s of Credit Approval? How Do I Apply for a Mortgage?

Credit Corp

JULY 25, 2021

Lenders can close your cards or cut your limits — here’s how to stop them. Card issuers may do this when they see changes in a particular cardholder’s creditworthiness or behavior. Reach out to the lender ASAP. In general, credit limit cuts are more common than account closures. Still, an unexpected change can be frustrating.

Better Credit Blog

MAY 20, 2022

While terms vary from lender to lender, personal loans are usually repaid over the span of 12 to 84 months. The personal loan process starts with the application, which can be completed online with most lenders. Lenders will look at your credit report and income to assess your ability to repay your loan.

Better Credit Blog

JULY 14, 2020

Mortgage lenders will take a look at more than just your credit score, utilizing what’s known as a tri-merge credit report to gauge your credibility. In the guide below, we’ll provide you with all the details you need to know about your tri-merge credit report, how lenders use it, and how you can access the information it contains.

Credit Corp

APRIL 26, 2023

Do this before you talk with a lender or apply to refinance. Private mortgage insurance (PMI) is sometimes required by lenders if you borrow more than 80% of the home’s sale price—in other words, don’t make a 20% down payment. Get a loan estimate from each lender. There are a lot of reasons to refinance your home loan.

Credit Corp

AUGUST 24, 2021

Vacation loan amounts typically start from $1,000 and can go as high as $100,000, depending on the lender. Relatively Lower interest rates : Lenders may lend you funds at a lower interest rate depending on your credit score and other financial features. They work just like other personal loans. How Much Could the Vacation Loan Cost?

Credit Corp

JUNE 14, 2023

A hard credit inquiry is when a credit card issuer or another lender reviews a credit report as part of your credit application. It happens when the lender or bank associated with your credit card company checks your credit report to see if you are eligible for acceptance. They’re also not usually visible to lenders or banks—only you.

Credit Corp

AUGUST 19, 2021

Depending on your situation, you may need to save up a large down payment, prove your creditworthiness and then find a home a lender agrees is in your price range. Most mortgage lenders report timely payments to the credit bureaus, which can be a positive impact to your credit. Does Rent-to-Own Build Your Credit?

Credit Corp

JUNE 29, 2020

This data is supplied by lenders, creditors and businesses where you have accounts. Higher credit scores are more attractive to lenders and creditors. This card offers a process that presents you with a credit line based on your creditworthiness before you apply.

Public Citizen

OCTOBER 31, 2020

Regulatory status of “Fintech” (internet based) lenders, “earned wage advances,” and use of expanded creditworthiness factors by fintech lenders potentially resulting in discrimination. Congressional veto of CFPB Rule banning class action waivers in arbitration clauses.

Credit Corp

SEPTEMBER 7, 2020

Lenders use a multitude of scoring methods to determine your creditworthiness and make decisions about whether or not to give you credit. Having numerical ranges that are somewhat consistent helps make the credit score process less confusing for consumers and lenders. Understanding the Scoring Models.

Taurus Collect

JANUARY 2, 2023

If you fail to pay back your creditor or lender or miss out on instalments regularly, they may resort to a debt collection agency or sell your account to a debt buyer. In fact, once the lender has hired a debt collection agency, you will make payment directly to the agency instead of the original creditor.

Credit Corp

JULY 1, 2024

It shows lenders that you have a history of responsibly managing credit and can qualify you for better loan terms and lower interest rates. Lenders use them to determine if you qualify for auto loans, home loans, credit cards and other products. Some lenders may have slightly different ideas of what is classified as a prime score.

Public Citizen

MARCH 21, 2022

Here's the abstract: The use of algorithmic credit scoring presents opportunities and challenges for lenders, regulators, and consumers. Third, to level the playing field between financial institutions and other lenders that use algorithmic credit scoring.

Credit Corp

MAY 3, 2021

Second, business credit can refer to the creditworthiness of the business as an organization. Lenders, business partners and others can evaluate this worthiness by looking at the business’s credit report and score. The lenders report to the credit bureaus, and your credit history is automatically established.

Debt Guru

OCTOBER 22, 2021

Here are four important things that your lender might not tell you – but knowing them can spare you a world of financial hurt. Many lenders permit you to name your own deadline, so you can choose a date that works best (such as a deadline that falls after payday). Understand What You Owe. Know When Your Payment Is Due.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content